portland oregon sales tax rate 2020

Portland Sales Tax Calculator. Portland voters approved Measure 26-210 to impose 1 tax to fund.

Washington Sales Tax Rates By City County 2022

Exact tax amount may vary for different items.

. What is the sales tax rate in Portland Oregon. Post OR Sales. The December 2020 total local sales tax rate was also 0000.

There are six additional tax districts that apply to some areas geographically within Portland. Portland property tax - parks assessed property value 112021 39 48 million Portland public school property tax assessed property value 112021 39 125 million Multnomah County business income tax Increase in business income tax rate from 145 to 20 112020 100 137 million Multnomah County individual income tax. For tax years beginning on or after January 1 2019 the Clean Energy Surcharge CES is imposed on businesses that have at least 500000 in Portland gross income and 1 billion in total gross income.

The highest mill-rate is within the City of Portland and Multnomah County. View City Sales Tax Rates. There is no applicable state tax.

Oregon is one of five states with no statewide sales tax but Oregon law still allows municipalities or cities to enact their own local sales taxes at their discretion. Compare sales tax rates by city and see which cities have the highest sales taxes across the United States. Oregon cities andor municipalities dont have a city sales tax.

Honolulu Hawaii has a low rate of 45 percent and several other major cities including Milwaukee and Madison Wisconsin keep overall rates modest. In 2019 and 2020 Portland and Oregon will impose new gross receipts taxes. The County sales tax rate is.

The December 2020 total local sales tax rate was also 0000. A home tax assessed at 242000 a real market value of 390K with a mill-rate of 1640 would owe annual property taxes of 3968. Over the years the tax rate has increased from 6 in 1976 to 146 in 1992.

Please complete a new registration form and reference your existing account 3. Instead of the rates shown for the Portland. If a taxpayer would have met the 90 threshold under the prior years rate 145 for tax year 2020 but does not meet the 90 threshold under the new BIT rate 200 quarterly interest will be waived.

Bureau of Financial Services. Visit our Clean Energy Surcharge page for more. The Oregon sales tax rate is currently.

The Portland sales tax rate is. Oregon OR Sales Tax Rates by City A The state sales tax rate in Oregon is 0000. Portland OR Sales Tax Rate.

The City of Portland Oregon. Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland Portland Salem Beaverton and Eugene and 102 other cities. The Clean Energy Surcharge CES and the Corporate Activity Tax CAT respectively.

The company conducted more than 200 transactions to South Dakota. The current total local sales tax rate in Portland OR is 0000. On May 19 2020 voters in the greater Portland Oregon metro area 1 approved Measure 26-210 imposing a new 1 tax on certain individuals and a 1 business profits tax on certain businesses.

The companys gross sales exceed 100000 or. Wayfair Inc affect Oregon. Rates include state county and city taxes.

This rate includes any state county city and local sales taxes. The County sales tax rate is. The lower three Oregon tax rates decreased from last year.

Oregon Sales Tax Oregon does not collect sales taxes of any kind at the state or local level. Tax rates last updated in January 2022. Required every tax year.

The Portland sales tax rate is NA. Beginning with tax year 2021 the new taxes are imposed on businesses and individuals in Washington Clackamas and. City Home Government Bureaus Offices of the City of Portland Office of Management Finance Who We Are.

The tax would apply to retailers with more than 1 billion in national sales and 500000 in Portland-specific sales. For more information and a flowchart to determine if vehicle use tax is due. The minimum combined 2022 sales tax rate for Portland Maine is.

Many other states are formalizing guidance through laws and regulations regarding collecting sales tax on online sales. The December 2020 total local sales tax rate was also 0000. Instead of the rates shown for the Portland Tourism Improvement District Sp tax region above the following tax rates apply to these specific areas.

Revenue generated by the new taxes will help fund homeless services. The minimum tax would be in addition to the 100 minimum tax described in Section 702545 if applicable. Portland Tourism Improvement District Sp.

Oregon cities andor municipalities dont have a city sales tax. The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0. In 2019 property taxes to pay for this bond will go up by 24 cents per 1000 in assessed value for Portland homes in each of the three counties.

Wayfair Inc affect Maine. That comes out to about 60 for a home with an assessed value of of 250000. Last updated April 2022.

For example under the South Dakota law a company must collect sales tax for online retail sales if. Did South Dakota v. Did South Dakota v.

2020 rates included for use while preparing your income tax deduction. Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland. The Maine sales tax rate is currently.

There are no local taxes beyond the state rate. Sales tax region name. The minimum Heavy Vehicle Use Tax due for a tax year is 100.

For the tax years beginning on or after January 1 2020 this tax is 3 percent of the total Oregon Weight-Mile Tax calculated for all periods within the tax year. In 2019 and 2020 Portland and Oregon will impose new gross receipts taxes. Some rates might be different in Portland.

Sales Tax Calculator Sales Tax Table. Oregons sales tax rates for commonly exempted categories are listed below. Taxpayers may submit a waiver request along with their 2020 combined tax return.

Oregon state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with OR tax rates of 475 675 875 and 99 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. In the Portland Metro area mill-rates range from 1500 to 2030. The same three lower income tax bracket.

This is the total of state county and city sales tax rates. The total amount to be raised through property taxes is nearly 653 million over the course of 30 years. The mill-rate varies from one community to another.

The Portland sales tax rate is. And in 2020 Lincoln Institute determined that Portland proper ranked in the top 5 in the entire country. Portland OR Sales Tax Rate.

Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets 10. 54 Taxable base tax rate. Nor Portland Oregon impose any state or local sales taxes.

To this end we show advertising from partners and use Google Analytics on our website. The minimum combined 2022 sales tax rate for Portland Oregon is. 2020 rates included for use while preparing your income tax deduction.

Join speakers Nikki Dobay Senior Tax Counsel at Counsel On State Taxation COST Dan Eller Shareholder at Schwabe Williamson Wyatt and Valerie Sasaki Partner at Samuels Yoelin. This is the total of state county and city sales tax rates. What is the sales tax rate in Portland Maine.

The Portland Oregon general sales tax rate is 0. The Portland Oregon sales tax is NA. View County Sales Tax Rates.

2022 Oregon state sales tax.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

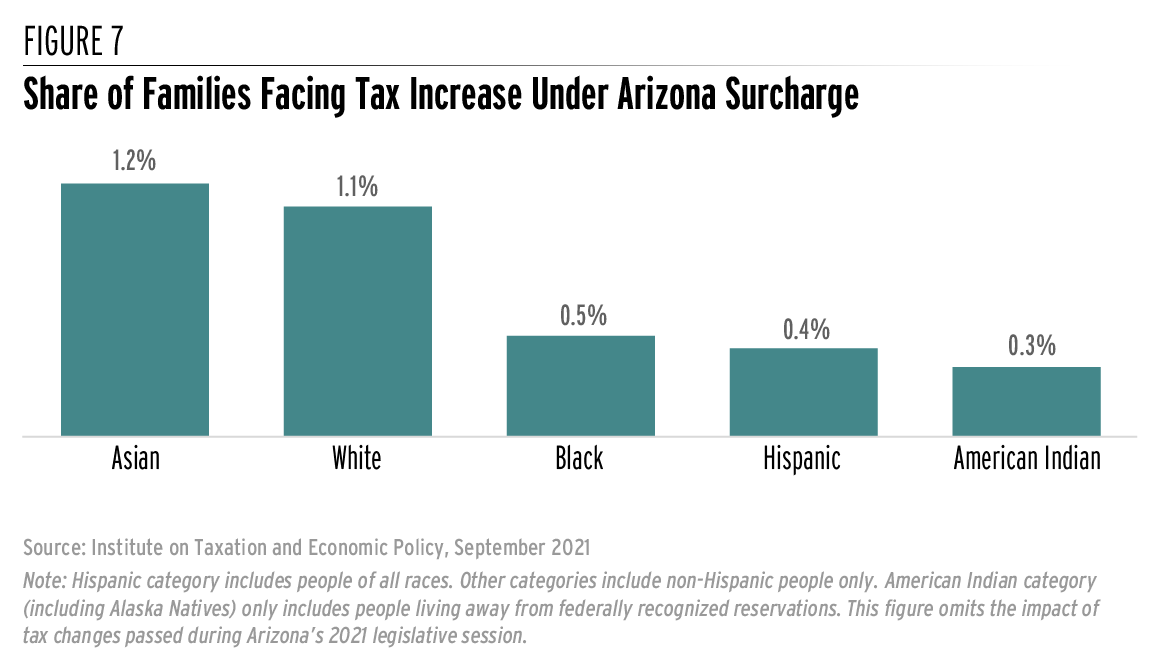

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Texas Sales Tax Rates By City County 2022

States With Highest And Lowest Sales Tax Rates

Montana Tax Information Bozeman Real Estate Report

New Sales Tax Rules For Oregon Residents Overturf Volkswagen

Sales Taxes In The United States Wikiwand

States With Highest And Lowest Sales Tax Rates

Sales Taxes In The United States Wikiwand

Sales Tax By State Is Saas Taxable Taxjar

Sales Taxes In The United States Wikiwand

Oregon State 2022 Taxes Forbes Advisor

Sales Taxes In The United States Wikiwand

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Origin Based And Destination Based Sales Tax Rate Taxjar

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

Montana Tax Information Bozeman Real Estate Report